Pvm Accounting for Dummies

Pvm Accounting for Dummies

Blog Article

Some Known Details About Pvm Accounting

Table of ContentsPvm Accounting Can Be Fun For AnyoneSome Known Facts About Pvm Accounting.Indicators on Pvm Accounting You Need To KnowExamine This Report about Pvm AccountingFascination About Pvm AccountingA Biased View of Pvm Accounting

Make sure that the accountancy procedure conforms with the legislation. Apply called for construction accounting requirements and treatments to the recording and coverage of building and construction task.Understand and maintain typical price codes in the accounting system. Communicate with numerous funding agencies (i.e. Title Company, Escrow Company) concerning the pay application process and requirements required for repayment. Handle lien waiver dispensation and collection - https://disqus.com/by/leonelcenteno/about/. Display and settle financial institution concerns consisting of charge anomalies and check distinctions. Aid with implementing and maintaining inner economic controls and treatments.

The above declarations are meant to describe the basic nature and degree of work being performed by individuals designated to this classification. They are not to be interpreted as an extensive listing of obligations, responsibilities, and abilities needed. Personnel might be needed to perform duties outside of their regular duties from time to time, as required.

Not known Details About Pvm Accounting

Accel is looking for a Construction Accountant for the Chicago Office. The Building Accounting professional performs a range of audit, insurance compliance, and task administration.

Principal responsibilities include, however are not limited to, handling all accounting functions of the company in a timely and precise fashion and giving reports and schedules to the company's certified public accountant Firm in the prep work of all economic declarations. Makes certain that all accountancy treatments and features are handled precisely. In charge of all economic documents, pay-roll, financial and everyday procedure of the audit feature.

Prepares bi-weekly trial equilibrium records. Works with Project Supervisors to prepare and post all month-to-month billings. Processes and issues all accounts payable and subcontractor settlements. Creates regular monthly recaps for Employees Payment and General Liability insurance coverage premiums. Creates regular monthly Job Price to Date reports and collaborating with PMs to fix up with Task Supervisors' allocate each job.

Some Ideas on Pvm Accounting You Should Know

Proficiency in Sage 300 Building And Construction and Property (previously Sage Timberline Workplace) and Procore construction administration software program an and also. https://peatix.com/user/22310354/view. Should additionally be competent in other computer system software application systems for the prep work of records, spread sheets and other bookkeeping evaluation that might be required by management. construction bookkeeping. Need to have solid organizational skills and ability to prioritize

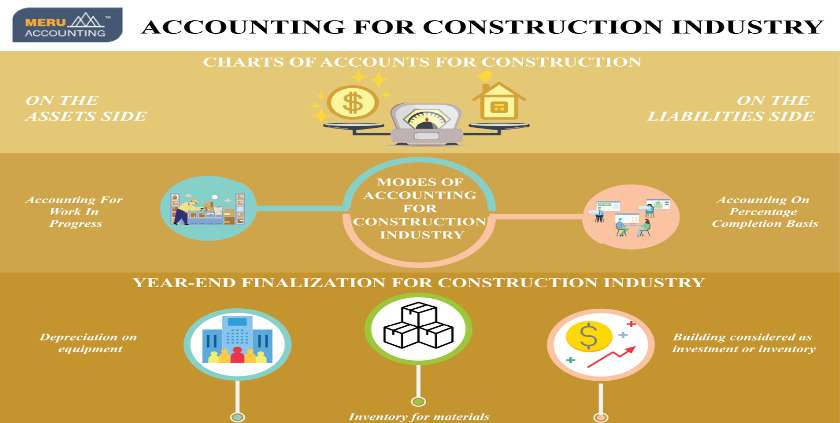

They are the monetary custodians that ensure that construction projects remain on budget, abide by tax laws, and preserve click here to read monetary openness. Construction accountants are not just number crunchers; they are tactical partners in the building procedure. Their main function is to handle the monetary facets of construction tasks, ensuring that sources are alloted efficiently and monetary dangers are lessened.

The Ultimate Guide To Pvm Accounting

By preserving a limited grip on project funds, accountants assist prevent overspending and monetary setbacks. Budgeting is a cornerstone of effective construction jobs, and building and construction accountants are critical in this regard.

Browsing the facility web of tax guidelines in the construction market can be difficult. Building and construction accountants are skilled in these laws and guarantee that the job abides with all tax obligation demands. This consists of managing payroll taxes, sales tax obligations, and any kind of other tax obligation commitments specific to construction. To master the function of a construction accounting professional, people need a solid educational structure in bookkeeping and financing.

Additionally, certifications such as Cpa (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Building Market Financial Professional (CCIFP) are very concerned in the industry. Functioning as an accounting professional in the building and construction market features an one-of-a-kind collection of difficulties. Construction tasks usually entail limited due dates, changing policies, and unexpected expenses. Accounting professionals need to adapt quickly to these challenges to keep the task's monetary health undamaged.

A Biased View of Pvm Accounting

Ans: Building accounting professionals produce and keep an eye on budget plans, recognizing cost-saving chances and ensuring that the task stays within budget plan. Ans: Yes, construction accountants take care of tax conformity for construction jobs.

Intro to Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction firms need to make hard choices amongst several economic choices, like bidding on one job over an additional, selecting financing for products or devices, or establishing a task's profit margin. Building is an infamously unpredictable market with a high failing price, slow time to payment, and inconsistent cash circulation.

Production includes duplicated processes with quickly recognizable prices. Production needs various processes, products, and tools with differing costs. Each project takes location in a new place with varying site conditions and special obstacles.

The Best Strategy To Use For Pvm Accounting

Durable connections with suppliers alleviate settlements and enhance effectiveness. Inconsistent. Constant usage of different specialty specialists and vendors impacts effectiveness and money circulation. No retainage. Settlement shows up in full or with regular payments for the complete agreement amount. Retainage. Some portion of settlement might be kept until job completion even when the contractor's job is ended up.

While conventional makers have the benefit of controlled settings and optimized manufacturing procedures, construction business should regularly adjust to each new job. Also rather repeatable tasks call for adjustments due to site problems and various other variables.

Report this page